Accounts Receivable (A/R) is a common component of doing business but should not be viewed as the cost of doing business. Simply, there is an inverse relation between aging A/R and A/R collection, meaning the likelihood of collection decreases as time passes, so you want to do your best to avoid this conundrum.

What is a good A/R collection ratio?

On average, practices have a 20% or less chance of collecting A/R older than 90 days. So, what is a good collection ratio for A/R? A good collection ratio is above 95%, and a great collection ratio is anything above 98%.

If you’re a numbers person this part is for you. Data gathered from multiple sources including ADA show that the average American dental practice carried a total A/R balance of $116,000~. The average amount for A/R older than 90 days stood at $50,000 per dental practice. If we do the math, and multiply the 190,000~ dental businesses in the U.S. by $50,000, we get a staggering amount of money likely to be lost due to aging A/R – $9,500,000,000!

Key Performance Indicator

A key performance indicator (KPI) you could analyze to determine the health of your cash flow from an A/R perspective is days sales outstanding (DSO). This is calculated by dividing the A/R by the total credit sales multiplied by the number of days in the sales period. The purpose is to determine the average time it takes from an invoice being sent out to it being paid.

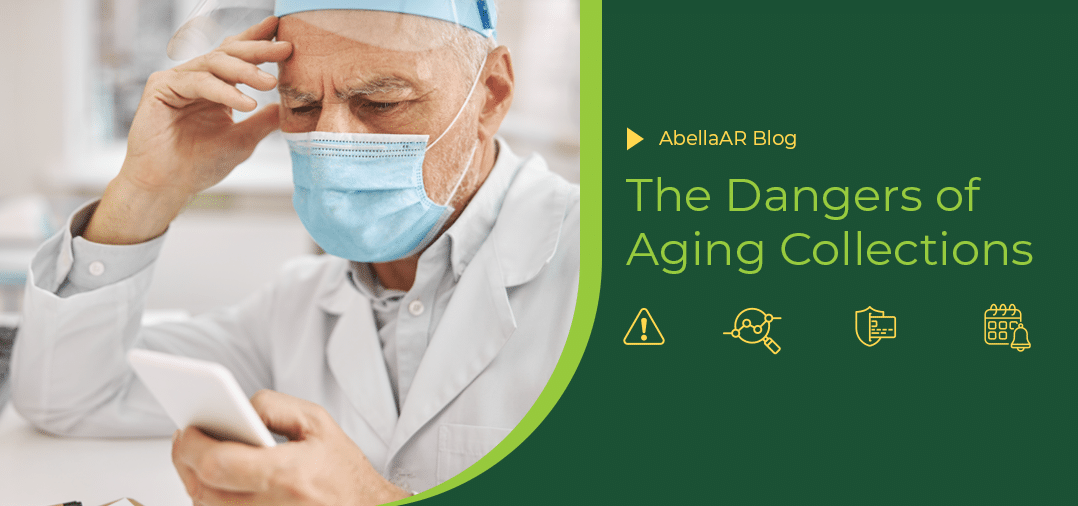

Risks of aging A/R

Like plaque, aging A/R is a silent assailant eroding your financial well-being. Nothing good can come out of aging A/R. On paper, it looks just like any other number, but not doing anything about it can lead to serious negative consequences for a dental practice.

- Less cash for investments

- Less cash for human resources

- Less cash-for-profit distribution

- Setting a bad precedent with clients which can lead to a snowball effect

- Financial stress spilling into the operating theater

- Poor customer experience and employee morale due to traditional A/R collection methods: phone calls and collection letters

- Pressure to cut corners to save money

In short, aging A/R poses an immediate and long-term risk for dental practices by eroding cash flow and affecting the ability to invest, the engine of growth for any business – so avoid it!